This is a systems practice, not a personal brand

Most financial guidance focuses on tactics — rates, products, timing.

My work focuses on systems: how financial institutions interpret behavior, structure risk, and make decisions.

That distinction matters, because outcomes aren’t driven by intent. They’re driven by inputs.

How I Think About Money

Money isn’t just math. It’s a set of rules applied to behavior.

Two people can earn similar incomes, spend similarly, and still receive very different financial outcomes. The difference usually isn’t effort or intelligence — it’s how their financial identity is interpreted by the systems they interact with.

When people understand that interpretation layer, decision-making improves quickly and sustainably.

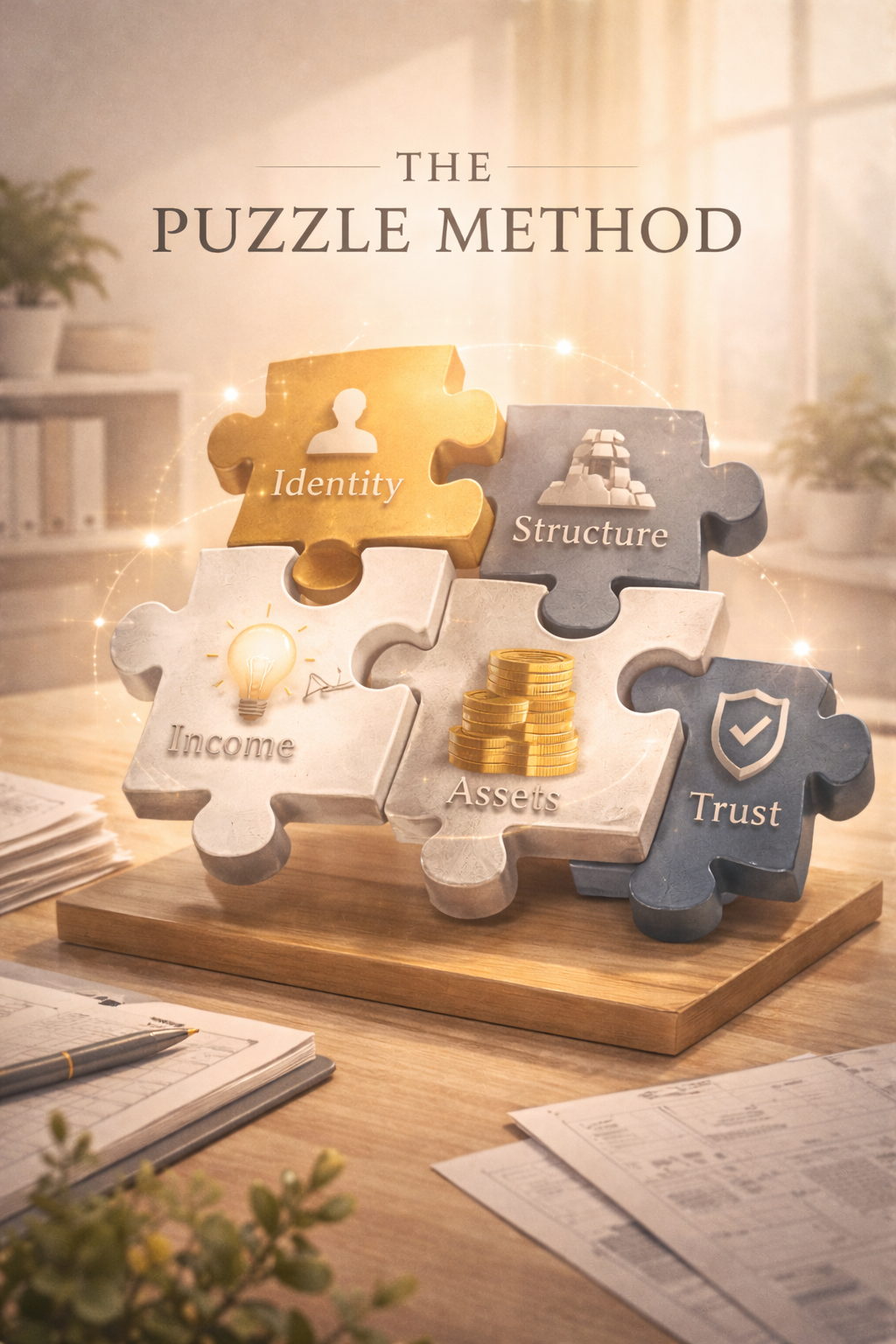

The Puzzle Method is a framework designed to explain how financial systems actually work.

It is built around five core levers:

Identity

Structure

Income

Assets

Credit (Trust)

These elements work together. Change one input, and the system responds differently. The framework helps individuals and professionals diagnose misalignment, understand risk perception, and make more intentional decisions within real-world constraints.

The Puzzle Method

Where this perspective comes from

This perspective is shaped by formal business training and sustained exposure to complex financial systems. Much of that work has lived in non-standard scenarios — situations where income, structure, and risk don’t behave cleanly and simple advice breaks down.

Over time, patterns emerge. Not just in numbers, but in behavior, incentives, and how systems consistently respond when things are misaligned. That pattern recognition is what informs the work — less focused on transactions, more focused on understanding why outcomes diverge.

Who this work is for

-

Professionals who influence financial decisions

-

Teams that need shared language and clarity

-

Individuals navigating complexity rather than optimization

Why This Matters